|

|

| Home - Software M&A Review - Dec 02 Issue |

Software M&A - Third Quarter 2002 M&A Update |

By Ken Bender, Managing Director and Allen Cinzori, Associate – Software Equity Group, LLC

Software M&A activity continues to lead all other industry sectors, with 362 transactions announced in the third quarter. On the whole, valuations continue to hover at two times seller’s last twelve months revenue. Buyers with cash on their balance sheets and an inclination to take advantage of current valuations include EDS, Geac, IBM, and Intuit. Others, such as Autodesk, have shifted their focus away from minority investments through their VC units, after massive write-offs, and are pursuing outright acquisitions. Today’s preferred target? Small and midcap software companies targeting vertical markets and mid-tier enterprises, provided they have a solid customer base, recurring revenue, and earnings. These are many of the same software companies that could hardly garner a second look from these buyers three years ago. Their appeal? Buyers seek close-to-home strategic acquisitions with short term cross-sell revenue payoffs.

M&A Analysis:

Software remains one of the more active sectors of the U.S. M&A market. During the first three quarters of 2002, there were 1,015 software transactions with an aggregate value of $22.2B according to MergerStat. Based on current trends, we estimate a total of approximately 1,350 software deals will be completed in 2002 with an aggregate value of some $30B. The total number of transactions is on par with 1998 levels; however, aggregate value harkens back further, to 1996 levels.

Our Behind-the Scenes analysis of last quarter’s M&A transactions identified two common themes - the desire for an entry into the mid-market ($150M-$1B) or a vertical sector, and the quest for increased market share and/or revenue from cross-selling the buyer's products into the seller's installed base and vice versa. Examples of transactions reflecting the latter theme include Geac / Extensity, Intuit / Blue Ocean Software, and Harland Financial Services / INTERLINQ Software Corp.

Transaction valuations, when measured as a multiple of the selling company's revenue, were relatively flat in Q3 compared to Q2. Of the ninety-five software transactions analyzed during the quarter, we calculated revenue multiples for twenty-eight. The median revenue multiple was 2.0, down 5% from Q2. The range was between 0.2 and 6.9 times. Nineteen of the twenty-eight sellers were private. Private sellers received a median valuation of 1.9 times revenue, 10% less than their public counterparts. Year to date, we have calculated revenue multiples for seventy-two transactions, with a median multiple of 2.0 for the period.

Cash continued to be the most common form of payment. Analyzing data from forty transactions where form of consideration was disclosed, 65% of transactions were cash only, 15% were stock only, and 21% involved both cash and stock. Relative to the first half of 2002, cash only transactions are up 58% and stock only deals are down 54%. Sellers don’t want to risk further decline and buyers believe their stock is undervalued.

Security, data/information management, and storage management continue to be the most active software M&A sectors. In the security space, Symantec led with acquisitions of Mountain Wave, Riptech, Recourse Technologies, and SecurityFocus. Symantec paid a combined $375M for these four companies, hoping to increase the strength of its intrusion detection and managed service offerings.

Public Market Analysis:

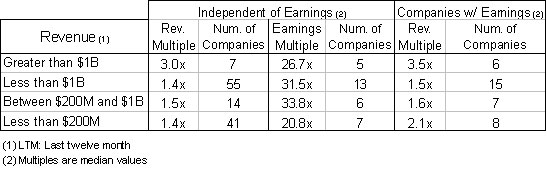

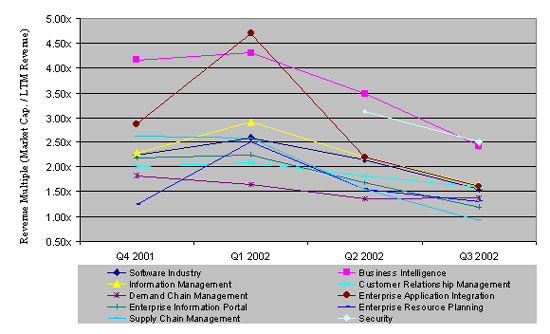

The bears continued to dominate the public markets during Q3, driving the Nasdaq down an additional 18%. Unfortunately, the software sector was not spared. Our software industry portfolio, which consists of sixty-two companies, lost 20% of its public market value, with a 26% decline in the median revenue multiple, to 1.6 times. The median earnings multiple was also down, falling 26% to 27.2 versus 36.9 in the second quarter. In general, the larger and/or more profitable the company, the higher the valuation as a multiple of revenue, as shown below.

It was a trying quarter for nearly all software sectors. Hardest hit were the supply chain management (-40%), business intelligence (-34%), and enterprise application integration (-27%) segments. Faring slightly better were customer relationship management (-13%) and demand chain management (+1%). This was the second consecutive quarter in which supply chain management and enterprise application integration experienced substantial declines. Security and business intelligence providers received the highest public market valuations, with median revenue multiples of 2.5 and 2.4, respectively.

Reduced corporate IT spending characterized the third quarter, though many analysts are predicting a slight seasonal uptick in spending for the fourth quarter. Morgan Stanley's September 2002 CIO survey identified application integration, security software, and Windows 2000/XP desktop upgrade as CIOs’ top three priorities. Last on the CIOs’ list were demand chain management, mainframe systems management, and CAD/CAM/EDA software. A recent Goldman Sachs" IT survey predicts 3% growth in IT investment spending in 2003 and growth of approximately 7% to 8% in 2004.

M&A Update is prepared by Software Equity Group, L.L.C. (SEG) which is solely responsible for its content. SEG (www.softwareequity.com) is one of the nation’s leading software industry M&A Advisories for privately held software companies. Established in 1992, SEG has served more than 300 companies in thirty states and six countries. This material is based on data obtained from sources we deem to be reliable; it is not guaranteed as to accuracy and does not purport to be complete. This information is not intended to be used as a basis for investment decisions.

|

|

|