|

|

| Home - Industry Article - Jul 06 Issue |

Crossroads: Deciding If and When a Founder Should Sell |

By Javier Rojas, Managing Director, Kennet Venture Partners LLC

If you are an entrepreneur that owns a majority or major stake in your business, you are often faced with the question of whether and when you should seek to sell your shares. This can be the hardest decision to make because the stakes are high – both through indecision or a misstep, and at the same time emotional because of the potential changes involved.

I have spent most of my career as an advisor and investor helping founders answer these questions. In the process I have developed a model for breaking down the decision process and helping to come to the right answer given the appropriate set of circumstances.

Variations of our approach can be used by any equity holder of a high growth technology company but it is most relevant to founder led businesses – businesses where the founder owns at least 10 to 20 percent of the company (often the majority) and the founder is active in the business. This combination enables a unique amount of control over the alternatives. It also ensures that each option will have a significant impact financially as well as on lifestyle and attainment of personal objectives. While the decision making process is more complicated, given the scenario and tradeoffs, the right choice can be more rewarding. We believe that all founders should complete this analysis as they weigh near-term opportunities and plan for an eventual realization of the value they have built in their business.

Decision Model

There are three major factors typically involved in the decision making process of when to seek a sale of shares: market, financial and personal. While there are invariably many issues to consider regarding a share sale, most of them fall in into one of these categories. It is difficult enough to address the complexities of any one of these areas, much less all three simultaneously. Making matters worse, these factors often are in conflict. As an example, what should you do if your market is growing fast and it looks compelling to hold onto your shares, but at the same time your business is worth so much that the financially smart move appears to be selling and retiring?

We recommend looking at each of these areas independently and score each one ad hoc based on whether the factors indicate a share sale is appropriate. Only then can you step back and see if the indicators are in agreement. If they are, then the decision is clear. If not, then one can focus on the tradeoffs, set a timetable for when they should align, or look for a mixed solution such as a partial sale of shares. Let’s review each of these categories and potential indictors within each.

Market

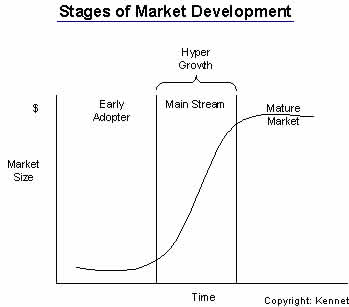

The first and perhaps most important determinant of when a share sale might be appropriate is the market for the company’s product or service. In technology, markets often grow in a non-linear fashion – they emerge slowly, primarily driven by early adopters, and then after a period of time the market expands rapidly. This hyper-growth phase is driven by mainstream buyers. In the third phase, the market growth slows as it becomes saturated and sales are driven by replacement purchase or late adopters. It is never easy to predict when the market will take off or when it will hit saturation; however, the founder should have a good feel for this. In addition, there are a number of independent indicators: accelerating sales, a pipeline that is growing quicker than previously, more new entrants validating the market, large customers sales are closing easier than in the past.

The first question: At what stage of market development is the company? If early and there is confidence in near-future growth, you may choose to wait since share value will likely grow faster than any alternative at hand. Once rapid market growth begins, share value will grow quickly. As a result, offers will have to be high relative to current performance to compensate for losing that opportunity. This is typically where you will see very high-value deals for young companies (Ebay/Skype).

We have helped many entrepreneurs realize high valuations at this stage by capitalizing on the early market lead in nascent but promising markets. A major determinant as to whether this is possible is the second variable in the market analysis: Are you positioned as the market leader? If so, then it is likely prudent to hold onto shares (unless someone offers you a very high price – we will cover this in the financial decision). If you are not the market leader, however you still hold third to fifth place, the sale may be more compelling to us because the lion’s share of market revenues and exit valuations are likely to accrue to the market leaders. If you are not well positioned to be one of the top two players, an early exit may be more compelling.

The third question relates to competitive threats: Has Microsoft or IBM entered your market? If so, ask yourself if it is relevant (free products/services) or likely to be a secondary factor. How defensible is your market position and your technology lead – how many months ahead of your competitors are you? Obviously the stronger the positions, the more security you have in maintaining your market lead.

Financials

The second decision category is more quantifiable – it is a comparison of the economics of a share sale today with a share sale in three to five years. The calculation involves predicting revenue growth over the next three to five years based on the above market review, calculating a future exit value for your shares after considering dilution from any anticipated financings. This analysis result in a range of valuations based on a range of valuation multiples on a future sale and different (low and high) growth expectations. Finally the values should be discounted back to today’s dollars to make the two comparable.

Depending on your level of confidence you can use a low discount rate or higher to try to equalize for increased risk. Use the discount rate to adjust for the risk factors involved in achieving this financial outcome. Does the team need to change? Has the founder led a company this large before? What are the factors that could stop the company from realizing its growth objectives on the timetable outlined? For a technology venture, a discount rate of 20 to 30 percent is usually appropriate to adjust for comparable risk. The result from this calculation is a range a values where the founder should be indifferent to selling shares today or holding onto them.

If your business is in the rapid growth phase of the market, and you see no other benefit in selling shares, then this analysis often leads to a decision not to sell shares (absent other factors). The reason is that if your business is growing rapidly, your share value will likely accumulate at such a fast rate that it is difficult to achieve full compensation today for your perception of future value. Others will likely put a higher discount on the future performance given both the risk and that in relation to the company’s historical performance a deal today would have to be very high. A sale of shares may be attractive, however, if other factors are favorable (market and personal) and if the founders receive other benefits as part of the sale – such as support in achieving the company’s growth potential. In high growth businesses, we have had good success in securing high-valuation exits for entrepreneurs in which we have invested.

|

|

|