By Chris Dowse, Founder & Chief Executive Officer and Ben Galison, Principal, Neochange, Inc.

What does the smart money know? What has the economic meltdown

exposed?

On May 22nd the stock market had valued the software industry at a 3.7% discount

to the S&P 500, based on the next-12-month price/earnings ratio. This isn’t

particularly striking until we consider that for the past five years, the

software industry has on average been priced at a 34% premium to the S&P 500.

What could account for this dramatic difference?

While there is definitely widespread uncertainty as to the timing and size of an

economic recovery, a swing of this magnitude suggests the market believes

something has fundamentally changed the software industry’s future capability to

generate earnings. It is an indication that the market believes a structural

shift is taking place and that the outlook for the coming year is dire.

The Perils of Swimming Naked: Does the Software Industry Deliver Value?

It's only when the tide goes out that you learn who’s been swimming naked.

Warren Buffet has a saying, “It’s only when the tide goes out that you learn

who’s been swimming naked.”2 He goes on to point out that during good times we

don’t know how much risk exists within any given company – the degree to which a

management team has potentially exceeded sustainable levels of the economic

drivers for their industry.

The financial services industry provides a familiar example to illustrate this

situation. As the economic crisis dawned, many financial company executives

continued with risky business practices despite the warnings that the

‘gravitational relationship’ between housing prices and incomes had been

exceeded. In the banking industry, these economic drivers are well established,

studied thoroughly and reported regularly. In the software industry, economic

drivers of revenue and benefit are somewhat less obvious and more difficult to

measure; however, data does exist and it presents a disturbing picture.

Software-driven productivity stalled well before the economic crisis

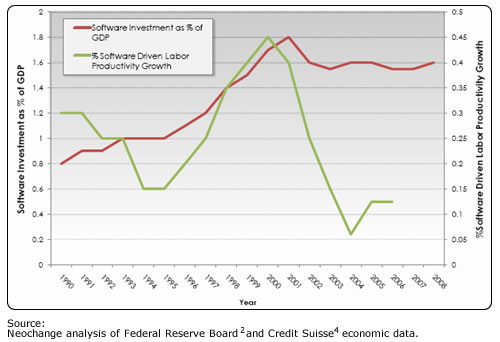

Figure 1: Comparison of software investment against software driven labor

productivity growth

A 2007 Federal Reserve Board report on US labor productivity reveals that the

software industry had exceeded the ‘gravitational relationship’ of software

investment levels (customer spending) and software-driven productivity (customer

value delivered)well before the economic crisis started3. Figure 1 compares the

contribution of software to US labor productivity improvement – a macro-level

measure of software-driven business benefit – and the relative level of software

investment as a percentage of US GDP.

The graph shows that since 2001, software spending moved consistently with the

growth of the economy (at a flat rate of around 1.5%), but that over the same

period the improvement in growth attributed to software declined nearly 40%.

While resolving this value delivery gap will require tackling some complex

issues, there are two certainties that will drive and shape the software

industry’s future beyond the economic crisis:

- Software Cannot Deliver Value if its Adoption Is Ineffective

Study after study (Butler Group5, Neochange/Sandhill6, CRM Magazine7) evidence

the fact that most enterprise software is still poorly adopted, regardless of

application type. These studies consistently peg average adoption rates at less

than 50%. Neochange’s own research indicates that 2 out of 3 buyers realize less

than 50% effective usage6. This is less an issue of shelfware than it is a

problem with companies not using software effectively to deliver value. As one

IT analyst describes it, companies are ‘oversoftwared.’8

- CIOs Are on a Long-Term Mission to Reduce Total Cost of Ownership (TCO) and

Prove IT Value

CIOs are accountable to their organizations for the ROI on technology

investments, and they are not happy. CIOs need to see a positive change in ROI:

As such, spending will go down until value delivered goes up. Regardless of the

causes, customers are not harnessing the value of their software investments and

they not only need, but expect help from their software providers.

Software companies cannot expect to continue earning a consistent share of the

economic pie when their contribution to customer success has deteriorated so

dramatically.

Put simply, the customer’s adoption problems are now the software provider’s

problem

The economic squeeze has forced IT organizations to cull software investments

that do not deliver. These changes in customer behavior and value expectations

are fast-paced and represent a significant threat to ISV revenue and earnings.

This threat will materially reshape the economics of the industry.

The next 12 months will reveal which software players have been ‘swimming

naked.’ Software companies can expect their very viability to be tested.

A Stress Test for ISVs: Will Headcount Reductions be Enough?

As a measure to stabilize the financial system, the US government created a

‘stress test’ for banks. ‘What-if’ scenarios were designed to determine whether

banks could survive the possibility of worsening economic conditions and to

enable them to take corrective actions if it appeared they could not. Current

economic conditions have already had a material impact on revenues in the

software industry. Recognizing that economic conditions will worsen, how can

ISVs gauge their risk?

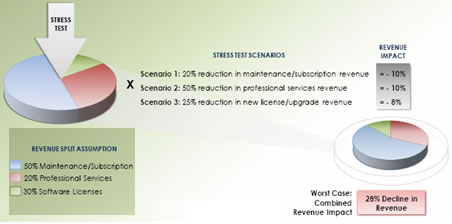

Below are three scenarios that ISVs could face within the coming year, which

individually and collectively would test the limits of many vendors.

Figure 2 describes the revenue impact of these scenarios. Figure 3 documents

industry events and trends to substantiate these scenarios and the magnitude of

their risk

Figure 2 Company Revenue Impact under ISV Stress Test Scenarios

|

Scenario 1:

20% Reduction in

Maintenance/Subscription

Revenue

|

Scenario 2:

50% Reduction in

Professional Services

Revenue

|

Scenario 3:

25% Reduction in

New License / Upgrade

Revenue

|

- Maintenance renewals continue trend of 5% quarterly reductions

- Heavy discounting on 2008 deals drives down average maintenance

contract values for years

- Customer pressure for price reductions increases to meet

internal IT budget cuts set beyond 2009.

|

- Customer discretionary IT spending cuts target the price points

of implementation/integration services

- Powerful user groups introduce KPIs for reducing total cost of

ownership (TCO) and optimizing business processes as conditions for

maintenance fees, thereby

cannibalizing existing services10

- Sales cycles continue to draw out as customer purchases require

additional levels of approval and ROI is further scrutinized

|

- Sales cycles continue to draw out as customer

purchases require additional levels of approval and ROI is further

scrutinized

- Advances in software utilization tracking provide

usage visibility to justify delaying upgrades until returns on prior

purchases are realized

|

Figure 3: Economic Stress Test for ISVs: ‘What-if’ Scenarios with Associated

Drivers

Could These Scenarios Become a Reality for Your Company?

Executive teams are not standing still – many have announced and implemented

cost reduction activities to protect earnings in the short-term. Reducing

headcount will help software companies weather a short-term earnings dip, but

for long-term viability, ISVs will need to create strategic blueprints for

helping customers succeed with effective product adoption and value realization.

Software leaders should take the following actions to strengthen their

companies.

No Bailout Is Coming: Software Executives Need to Act Now

- Align the Leadership Team to a Customer Value Mindset

The biggest barrier to the software industry’s future success is the outdated

mindset that software companies are in the product/feature business. In

actuality, services have for years dominated the customer’s total spend to reach

software-driven value. Buyers do not want software per se; rather, they are

after the value that software delivers: increased sales, operational

efficiencies, and product innovation. This does not mean ISVs should not strive

to be world-class product providers. But product innovation is ultimately

pointless if customers are unable to derive value.

The first step to move a company forward is refocusing the leadership team on

customer value. Executives need to adopt as a guidepost a shared vision of

customer value realization linked directly to their company’s products,

services, operations, and partners. Getting the CEO on board is paramount. The

CEO must be convinced that the current earnings shake-up requires a longer-term

investment in customer success, ahead of the sole pursuit of product innovation.

Unless the CEO is willing to shift business priorities and redirect company

efforts and investments to address the adoption problem, other actions will have

little impact.

As the software marketplace has evolved, the bar has been raised for ISVs across

the industry. Customers expect their vendors to be complete solution providers,

delivering innovative products with high levels of operational excellence and

customer intimacy. At this stage of the industry’s maturity, providing services

that enable customer success with products is a necessity for ISVs, not a

nicety. It can also be economically attractive. TPSA member research has shown

that customer accounts with professional services investments produce almost

triple total revenue and achieve higher renewal rates11.

- Institutionalize Customer Success across Company Silos

Once leadership is committed the vision of customer success should be put into

operation across the company. Nominating a Chief Adoption Officer (CAO) is a

powerful step and visible sign of commitment. Some forward-thinking ISVs have

already created this new, cross-functional role reporting directly to the CEO.

A cross-functional perspective is essential. In many ISVs customer knowledge is

fragmented, trapped in silos. Leaders must work across these silos –

particularly the services, support and sales functions – to ensure that key

customer information is brought back into the organization, shared among

employees and put to use enabling to customers to succeed.

Company metrics must also be aligned to adoption and customer value objectives.

Reorienting goals and rewards at both the executive level and throughout the

ranks is necessary to accomplish the wholesale shift in behaviors and mindsets.

For a company to transform, its metrics must change.

- Lead the Customer through Value-Centric Sales and Service

As the ISV reorients toward customer success, the organization fundamentally

moves from being in the product business to being in the productivity business.

Value assurance becomes the focus throughout the entire customer lifecycle,

including sales. Adopting a ‘value-delivered’ approach to sales and initiating

value/ROI discussions early in the sales cycle puts the customer relationship in

the proper frame right from the start. Arming the sales force with a ‘value

path’ that maps product capabilities to customer value drivers enables ROI to be

transparent, convincing and measurable. In addition to reshaping the sales

cycle, this evolution brings a greater importance to services that drive

adoption and effective usage of the product.

The Neochange/Sandhill Group software survey found that 95% of buyers want their

vendors to take a leadership role in driving adoption and the achievement of

value. The same survey also showed that 80% of buyers are willing to pay for

value assurance services to enable effective usage6.

The question for ISVs is which value assurance services to offer?

Which services do your customers most need?

Which will differentiate you from your competitors?

Large enterprise ISVs are already succeeding through wise choices on this front.

Oracle’s Advanced Customer Service group, for example, delivers services aimed

at reducing customer costs and optimizing customer business processes. Other

value assurance services may include ROI acceleration offerings, business domain

maturity assessments, or change leadership assistance.

Whatever the scope of the service portfolio, it is unlikely that any one company

can deliver everything with quality. As such ISVs also need to strengthen and

effectively lead partner ecosystems in the delivery of a solution-centric

approach. ISVs can no longer end customer services at the

implementation/integration stage and expect to drive sustainable growth.

Software Executives Face a Once-in-a-Lifetime Challenge.

Ironically, it is customer adoption, the bottleneck to sustainable growth, that

will be the path forward and out of the revenue trough that software companies

are experiencing. The current economic adversity impacting customers will

permanently raise the threshold for software companies to become more

customer-centric and value driven. Although this trend existed before the

meltdown, the pressure to reduce costs has accelerated changes, bringing new

levels of ROI scrutiny and accountability.

Thankfully, the arc of technology history is strewn with stories of innovation

in which companies rise through adversity and drive future growth. The survivors

of the next twelve months will be those companies that recognize the permanent

shift in customer behavior and expectations that has occurred and create their

own internal “stimulus package” focused on efforts to drive customer success.

REFERENCES

- Credit Suisse, Software Source, May 22, 2009.

- Warren Buffett, Annual Letter to Berkshire Hathaway Shareholders, February 29,

2008.

- Stephen D. Oliner, Daniel E. Sichel, and Kevin J. Stroh, “Explaining a

Productive Decade,” Federal Reserve Board, August 2007.

- Credit Suisse, Software Decoded, July 2008.

- Butler Group, “Exploiting Enterprise Applications,” March 2006.

- Neochange, Inc. and SandhillGroup, “Achieving Enterprise Software Success,”

January 2008.

- CRM Magazine, CSO Insights 2006 Sales Performance Optimization Study, July 2006.

-

http://advice.cio.com/thomas_wailgum/why_erp_is_underused_companies_are_oversoftwared

- ServiceSource, Service Performance Management Industry Report, Q4 2008.

-

http://blog.softwareinsider.org/2009/04/29/news-analysis-details-on-the-sugen-kpis-for-sap-enterprise-support/

- Thomas Lah, “Services Economic Impact Analysis”, May 2009.

Chris Dowse is CEO and Founder of Neochange, Inc. Ben Galison

is a Principal with Neochange. It is the leading management consulting firm

focused exclusively on the complex challenge of Effective IT Adoption.

Neochange’s innovative AdoptITTM methodology mitigates adoption risk and

accelerates corporate earnings improvement. For article feedback, contact Chris

and Ben at inquiries@neochange.com

|