|

|

| Home - Software M&A Review - Aug 02 Issue |

Software Remains the Hottest of the M&A Segments |

By Ken Bender, Managing Director, and Allen Cinzori, Associate - Software Equity Group

Summary of Findings:

Software remains among the hottest of M&A segments and acquisition multiples improved slightly in the second quarter. Total transaction volume and value grew somewhat, yet the "stick to your knitting" mentality remains prevalent among buyers. While healthy companies like Microsoft show a willingness to pay fair multiples for proven technologies, most deals are between businesses with similar products in similar markets. Recent surveys by both Goldman Sachs and Morgan Stanley indicate that demand for enterprise software remains soft with a majority of CIO's proceeding slowly, projecting to underspend their budgets for the remainder of the year. Finally, the heightened interest in corporate accounting has executives scurrying, in many cases focusing more on past accounting and reporting practices than on forward-looking growth opportunities.

M&A Analysis:

"Enterprise Software" was the hottest M&A category over the last six months as reported by Mergerstat, which identified 653 deals in the computer software, supplies, and services sector. This equates to approximately 19.2% of total M&A deal volume. Total transaction volume for the first six months declined to 1998 levels and total value to 1996 levels. Accounting scandals, quarterly earnings projections, and unfavorable financing are identified as big reasons for the dip to past levels.

There is good news for sellers. Median acquisition multiples, based on sellers" trailing twelve month revenue, improved in the second quarter of 2002. SEG identified twenty-eight software transactions from which a revenue multiple could be calculated. The median revenue multiple was 2.2, versus 1.9 for the first quarter of 2002 and 1.6 for the fourth quarter of 2001. Much of this increase is due to the fact that fewer businesses were being acquired out of bankruptcy. This also helped push the median deal size upward from $18M to $35M.

As would be expected, private sellers received slightly lower valuations than their public counterparts. Of the twenty-eight sellers, thirteen were private. Median revenue multiple for private sellers was 1.7, 39.2% less than the 2.8 multiple received by public sellers. This discount is in line with the average liquidity discount for private sellers of twenty-five to fifty percent.

Vertically focused acquisitions were in vogue during the second quarter. Leading the charge was Intuit, which acted on its "Right for my Business" strategy by signing agreements to acquire three vertically centric businesses. Sixteen percent, or fifteen of the ninety-four software deals SEG identified were vertically focused. The more active verticals included government, healthcare, and education.

The quarter's largest software transaction was Microsoft's $1.3B acquisition of Navision, a Danish CRM provider. This deal should allow Microsoft to expand its mid-market enterprise software presence in Europe. Currently, eighty percent of Microsoft Great Plains" revenue is generated in the U.S. When combined with Intuit's three deals, there was considerable activity in the mid-market. After much talk and speculation, the mid-market is now attracting attention from some of the large players.

Buyers continue to be conservative, as most acquisitions were of businesses with complementary products in similar markets. Examples include Cadence's purchase of Simplex, Smartforce's purchase of SkillSoft, and MSC.Software's purchase of Mechanical Dynamics.

Public Market Analysis:

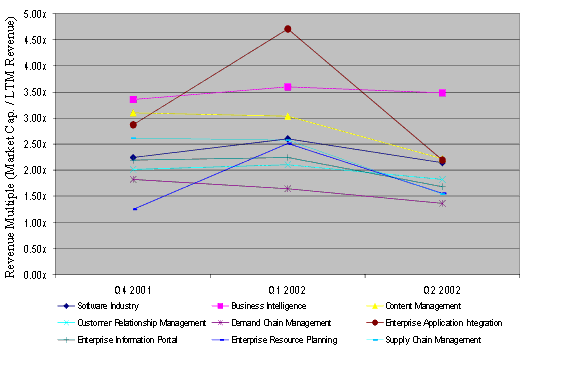

Unlike software M&A valuations, public market valuations were clearly down during the quarter. Similar to the Nasdaq, which fell 13.5% from its Q1 average, revenue multiples for the sixty-six software companies that SEG tracked were down by 17.7% and P/E ratios were down by 24.5%. The median revenue multiple for the quarter was 2.1 and the median P/E ratio was 36.9. Fueling this decline was soft product demand, a weakening dollar, and weakness across the broader market due largely to corporate accounting scandals.

It was a tough quarter for nearly all publicly traded software providers. Hardest hit were the enterprise application integration (-53.3%), supply chain management (-40.3%), enterprise resource planning (-37.8%), and content management (-27.0%) segments. Business intelligence and customer relationship management faired slightly better, falling 3.3% and 12.9%, respectively.

Software Equity Update is prepared by Software Equity Group, L.L.C. (SEG) which is solely responsible for its content. SEG is one of the nation's leading software industry M&A Advisories for privately held software companies. Established in 1992,SEG has served more than 300 companies in thirty states and six countries. This material is based on data obtained from sources to be reliable; it is not guaranteed as to accuracy and does not purport to be complete. This information is not intended to be used as a basis for investment decisions. Copyright 2002, Software Equity Group, L.L.C. All rights reserved.

|

|

|