|

|

| Home - Industry Article - Aug 07 Issue |

Increasing Software Provider Profits through Effective Usage |

By Chris Dowse, Founder and Chief Executive Officer, Neochange, Inc.

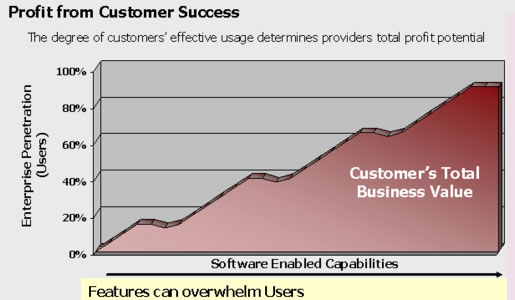

As growth rates in some verticals slow and new business models put pressure on prices, software executives are looking for new ways to grow profits. At the same time, enterprise buyers are struggling to achieve the levels of functionality utilization and user penetration that delivers desired business results. For many software verticals, enterprise buyers are achieving less than 20% of their potential business value. This effective usage challenge represents a significant opportunity for profit growth if providers are willing to redirect their focus and investments.

Software providers can increase revenues, reduce costs, and create competitive advantage by enabling effective usage of their software.

As growth rates in some verticals slow and new business models put pressure on prices, software executives are looking for new ways to grow profits. At the same time, enterprise buyers are struggling to achieve the levels of functionality utilization and user penetration that delivers desired business results. For many software verticals, enterprise buyers are achieving less than 20% of their potential business value.

While it is common for software companies not to have a measure for their customers’ level of effective usage, this lack of adoption is commonly understood in terms such as ‘shelf-ware’, ‘siloed-deployments’, ‘failed pilots’, ‘stalled implementations’ and so on. Further, a lack of effective usage is cited as the number one reason for the software industry’s 14% annual maintenance renewal erosion.

The effective usage challenge represents a significant opportunity for profit growth if providers are willing to redirect their focus and investments.

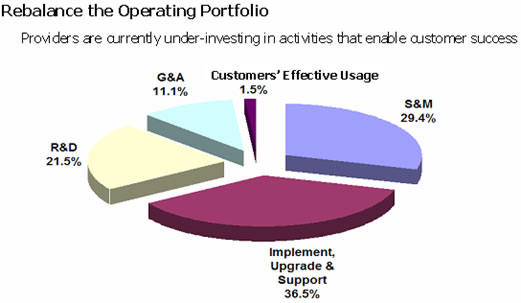

Software providers should not expect a greater share of the effective usage profit stream without increasing their level of investment in effective usage strategies. A Neochange study last year estimated that large enterprise software providers devote less than 1.5% of their ‘operating portfolio’ to enabling effective usage in their customer base. This same study recommended that providers increase their effective usage investment target to 4% just to protect their maintenance revenue streams. This suggests an even higher effective usage investment is required to achieve additional revenue and costs benefits.

The remainder of this paper discusses the revenue and cost benefits available to software providers who choose to enable their customers’ effective usage. Specifically we discuss the three critical investment decisions software executives face should they choose to pursue effective usage driven profits.

Investment Decision #1 – R&D Portfolio: Feature Innovation Vs Usability Innovation

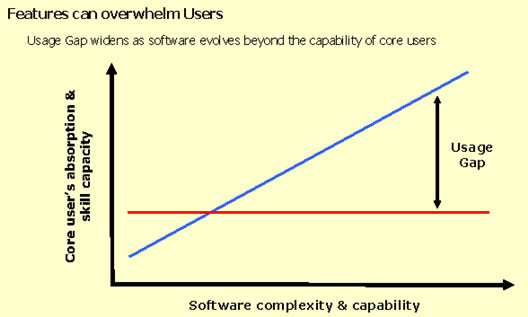

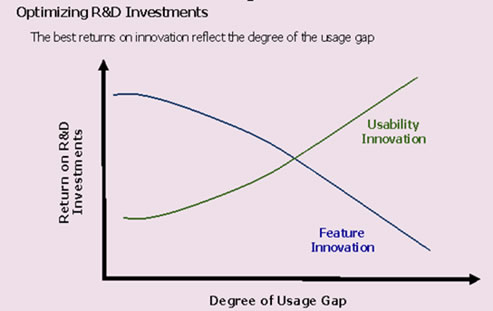

Often the volume and sophistication of software functionality overshoots the absorption capacity or basic skills of the average end user. When this occurs, it is questionable whether further investments in feature innovation are the best use of product development dollars. Many companies collectively spend billions of dollars on feature innovation even though the effective usage of their software has not evolved during several product releases. Clearly it doesn’t make sense from a return-on-investment perspective to create additional features that will likely suffer a similar fate.

For companies experiencing the ‘Usage Gap’ a higher return-on-investment can be achieved through usability innovation. Investments in usability are essentially focused on meeting the needs of the average end user as distinct from a software provider’s goal of developing new features to create market differentiation. This is a difficult investment decision to face as it goes against the natural instincts of a company that would attribute most of its success to building a better mousetrap.

At one extreme a focus on usability may involve stripping back to core functionality, while other less extreme changes may include the re-organization of menus, reducing the number of workflow steps, introducing contextual support and so on. The larger the usage gap, the larger the relative ROI advantage of usability innovation over feature innovation.

The challenge for software executives is to identify the degree of their usage gap for core customers, determine the appropriate innovation mix that optimizes R&D returns and convince feature-centric traditionalists to support an altered development focus.

Investment Decision #2 – Services Portfolio: Technical Implementation/Support Vs Customer’s Effective Usage

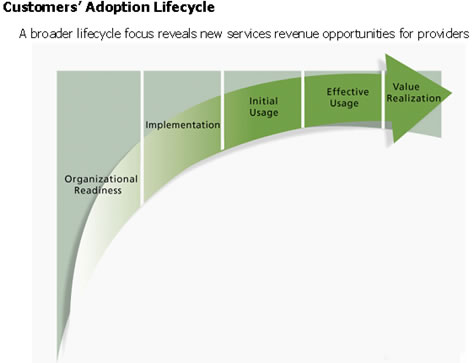

Traditionally, professional service arms of software companies are focused on technical implementation and support. If we consider the Adoption Lifecycle below, most software providers earn the bulk of their revenues from the implementation phase and technical support in the initial usage phase. Unlike in prior years, customers consider these services as a commoditized necessity of their software purchase, not a source of business value. As such, moving forward, services that enable effective usage will become increasingly important for service portfolios for two reasons.

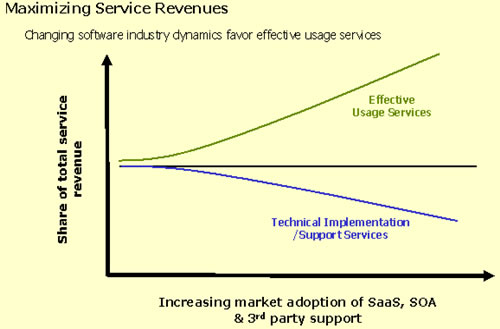

First, as the industry matures the price pressure on implementation and technical support services will increase. SaaS, SOA, third party maintenance all reflect the increasing trend toward lower costs for technical deployments and support. Customers expect advances in deployment methods and ‘self-configuration’ to result in a lower total cost of ownership (TCO). This expectation will be magnified in verticals where customers believe functional parity has been achieved.

Second, unlike implementation and technical support revenues, services that enable effective usage are not necessarily tied to software license prices. As the software industry matures and pricing compression drives license revenues downward, implementation and support revenues will follow. On the other hand, a provider’s revenue opportunity from effective usage services is determined by the customer’s potential business value divided by their relevant investment hurdle rate. Put another way, for a hurdle rate of 10%, customers are willing to spend $1 for every $10 of additional business value a software company can help them realize.

The investment decision software executives face will be – to what degree to spread their services portfolio along the entire adoption lifecycle. Factoring into this investment decision will be the degree of outsourcing to service partners. This will be necessary because the adoption lifecycle encompasses skills such as process redesign and organizational change management, specialized skills that are not necessarily readily available within a software provider’s staffing ranks. Regardless of outsourcing, software providers need to lead service partners if they wish to have any influence over the customer’s success with their product.

Investment Decision #3 – Sales & Marketing Portfolio: Customer Acquisition Vs Customer Retention

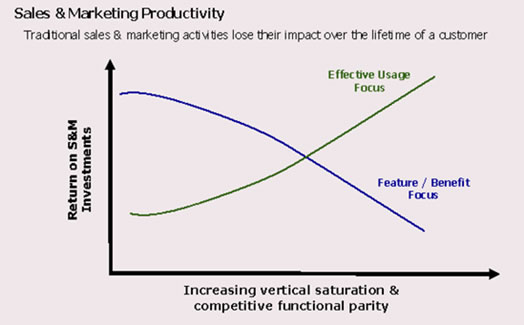

Few question that it is more cost effective to earn additional revenue from existing customers than to acquire them new. The question for any industry is really how much cheaper is this revenue growth strategy and what profit increase can the strategy provide. Some studies suggest that the cost of revenue acquisition is five times cheaper for revenue sourced from existing customers. If this is true for the software industry, then the economics of sales & marketing investments focused on preserving existing maintenance/subscription revenue streams is very compelling.

Furthermore, beyond the retention of existing revenue is the more strategic goal of maximizing the lifetime value of a customer. The business case for expanding customer license footprints and improving functionality utilization is even greater. What is required are marketing activities that confirm the value of the product to existing customers and more specifically lay out a roadmap for the customer’s journey to higher levels of value realization. Successfully executed, effective usage messaging can awaken latent customer demand and provide enterprise buyers with a vision of success for their deployments.

The investment decision facing software executives involves understanding the trade-off between acquiring and retaining customers while meeting the long-term goal of maximizing lifetime value of the customer. Fortunately effective usage materials can be utilized for both short-term ‘logo acquisition’ objectives & building enduring customer relationships.

Conclusion

In conclusion, the sources of profit from focusing on customers’ effective usage can be summarized as follows:

Increasing revenues through:

- Maintenance/subscription renewal protection

- Expanding license footprints across the customer enterprise

- New professional services focused on enabling effective usage

Reducing costs through:

- Optimizing product development expenditures

- Increasing the productivity of sales & marketing activities

It is obvious that the investment decisions discussed pose a significant leadership challenge for each function within the software organization. What may be less apparent is that at all times these investment decisions compete against each other for the company’s attention and resources. This competition can lead to misalignment & inefficiency as each group pursues its own agenda. In this situation effective usage can act as a unifying goal that realigns enterprise activities to a common purpose – increasing customer value realization and capturing an increasing share of potential profits.

Bold leadership is required to realize effective usage driven profit. This leadership involves questioning fundamental business assumptions that have previously driven success in the software industry. Executives that can successfully navigate the necessary changes in their strategy and tactics will maintain profitable growth.

Chris Dowse is Founder and CEO of Neochange Inc., the leading management consulting firm focused exclusively on the complex challenge of Effective User Adoption. He has consulted with IT executives of Fortune 500 companies such as Wells Fargo, Cisco, and McKesson in the areas of user adoption, IT management and IT driven organizational change. As an internal consultant to one of the world’s largest resource conglomerates, (BHP, Biliton) Chris has worked in 12 different countries identifying implementation risks and benefit realization drivers for multi million dollar capital projects. In more recent years, he has turned his focus towards these same business challenges in the software industry. Chris is a cited industry thought leader on user adoption. He has presented at leading industry conferences and has been published in industry publications on how software vendors and Fortune 500 organizations can address user adoption challenges. For article feedback, contact Chris at

inquiries@neochange.com

|

|

|