By Chris Dowse, Founder and CEO, Neochange, Inc.

Tipping points are rarely caused by a single, isolated trend or

event. This is why extreme statements of causality such as ‘SaaS will kill

software!’ or ‘Open Source will destroy Microsoft!’ seem far-fetched.

Is there any one tipping point factor that accelerates pricing erosion?

One such factor does exist, and as is often the case with evolving tipping

points, is not being widely discussed. This factor is the growing transparency

of enterprise software utilization, which has become an important force in the

software industry’s long-predicted pricing erosion.

This opinion paper examines the implications of usage transparency on software

pricing. Further, it discusses the decisions and actions independent software

vendors (ISVs) must make to protect themselves from low levels of customers’

effective adoption.

Limited Usage Visibility Inflates Software Prices

Software pricing is less a cost-plus calculation than a value guessing game. To

date, this game has been successfully managed by sophisticated software

executives and supported by industry analysts. Software buyers, on the other

hand, have grappled with the challenge of connecting the price they pay with the

software’s value contribution.

This inability to tie down the true value of enterprise software is one of the

main demand-side reasons the industry has eluded commoditization and lower

prices.

Although buyers struggle to comprehend the value of software, what is readily understandable is that software that is not used delivers no value.

Software that is not effectively adopted cannot deliver expected results. As an

underutilized asset, it has significantly less value in the eyes of the buyer. A

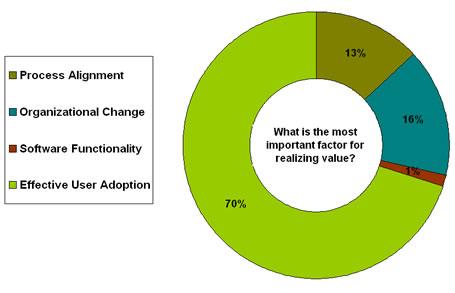

recent survey of software executives conducted by Neochange and SandHill.com

(Figure 1) confirms this view, with 70% of respondents citing effective adoption

as the key driver of business value.1

Luckily for vendors, as difficult as value is to define, effective adoption has

been equally difficult to measure. Most enterprise buyers have limited

visibility into how their enterprise applications are used and therefore cannot

understand the degree of value their software is contributing. However, this

scenario is changing, and the pricing game is swinging back to favor buyers.

Figure 1: Effective Adoption Drives Business Value

Realization

The Quiet Rise of Transparency

While the software industry has been busy debating the

impacts of SOA, SaaS, open source and other vendor-centric

innovations, transparency into a buyer organization’s level of

effective adoption has been growing. Consider these three fronts

of buyer-centric innovation, all angling to serve their true

master – the enterprise software buyer.

Front #1: Automated License Tracking Exposes Shelfware

2007 was the first year in which over 50% of buyers automated

their software management processes.2 At current

adoption rates, critical mass for automated license tracking

products will be reached this coming year. While initially

focused on compliance risk management, the improved usage

transparency this technology provides is also clearing out ‘shelfware.’

In fact, 30% of software maintenance contract cancellations are

attributable to a lack of effective adoption. 3

Front #2: Application Mapping Reveals Usage & Total Cost of

Core Applications

Application mapping through a configuration management database

is another asset management technology that is expected to

penetrate enterprise buyers significantly over the next few

years. Since application mapping reveals the total cost of

supporting applications as well as their degree of utilization,

buyers will be able to perform very accurate ROI analyses on

their application portfolios.

Industry pundits forecast that enterprise buyers will be able to

reduce application support costs by 10% – 30% through this new

visibility. 4 Much of these savings will come

directly from software providers’ pockets.

Front #3: End User Experience Monitoring Creates Complete

Visibility

This software category focuses directly on usability. Originally

intended to improve application performance and availability,

the technology also provides highly granular utilization

reporting. Some vendors have created application specific

templates to analyze adoption.

While current market penetration is low, adoption by enterprise

buyers is predicted to explode to 32% within the next two years.

5 This unprecedented level of usage visibility will

drive a new dialogue about software’s value – grounded in data.

As these three buyer-side technology innovations reach deeper

into the enterprise software market, what will they show about

the current state of effective software utilization?

Caveat Venditor: Buyers Struggle with Adoption

Enterprise software buyers are struggling with effective usage.

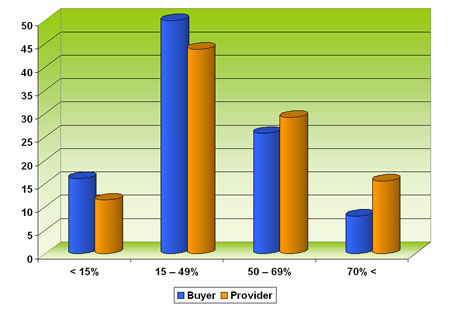

The recent Neochange and SandHill.com survey (Figure 2) revealed

that almost two-thirds of enterprise buyers achieve less than

49% effective adoption. 1

Figure 2: Most Enterprise Buyers Achieve Low Effective Adoption

Source: Neochange & SandHill.com 2008 survey

These findings are consistent with other software studies and

should deeply concern software executives as usage transparency increases over

the next two years.

This usage crisis is no longer the buyer’s problem – with buyer expectations driving usage-based pricing and economic conditions squeezing IT budgets, low usage has become a major revenue risk for enterprise software providers.

Software companies underestimate the magnitude of this revenue risk as they fail

to link falling new license growth and maintenance renewal erosion to their

customers’ struggles with adoption. Immediate adoption solutions are required to

mitigate revenue risk.

Beyond Product Innovation for Adoption Solutions

It is common to think that newer or better features will solve a customer’s

utilization problems. After all, innovative functionality is the genesis of most

software companies and often attracts new buyers.

However, does it really make sense to spend millions of dollars developing and

marketing new products when the average user is already overwhelmed by existing

features, or when the software itself has little to do with the lack of

effective adoption, which is generally the case?

Taking this line of thinking to its logical conclusion, no software executive

should spend another dollar until the following simple questions can be

answered:

- What is the effective adoption rate within my customer base?

- What are the customer’s effective usage barriers that prevent

maximum business value from my product?

-

What practices exist within my company that prevent or

undermine the customer's ability to achieve effective adoption?

For most software companies, the answers will produce the startling conclusion that much of the company’s operating investments are misdirected to lower-yielding activities. That is, much of an ISV’s cost structure goes to developing, marketing and selling features that will never be used. Meanwhile, existing customers are being lost.

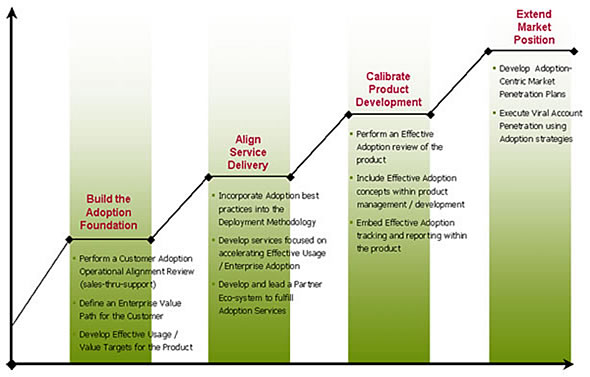

This short-term customer acquisition investment model is outdated for many software companies that compete in mature verticals. Because software itself is the smallest part of a customer’s total cost of achieving business value (see Figure 3) customers can easily retire unused software, or switch to another provider's product.

What is required, moving forward, are more investments that directly enable customers’ effective adoption and are less concerned with achieving mere technical development, implementation and support.

Figure 3: Software is the Smallest Part of the Buyer's Total Cost to Achieve Business Value

Investing in Customer Adoption for Sustainable Growth

The transformation to sustainable growth will be extremely difficult for

many software companies. For some it will involve change at the core – a

re-imagining of the company’s fundamental purpose.

A description of the ISV’s transformation path (Figure 4) cannot be done justice

within the confines of this paper. However, two key actions will help companies

get started.

Action #1: ‘Size the Prize’

Any significant change needs to clearly articulate organizational benefits

to ensure executives and employees will support a new way of doing business. As

such, ISVs should first quantify the economic impact associated with enabling

customers' effective adoption to drive organizational commitment to their

transformation.

ISVs that sell enterprise applications can conservatively target adoption-driven earnings gains equivalent to 15% of existing revenues.

The types of benefits that deliver this direct earnings impact include:

- Increased maintenance renewals

- License up-selling & cross-selling

- Higher pricing from greater utilization

- Higher levels of upgrades

- Lower support costs

- Higher services margins

- Value assurance services revenues

Action #2: Realign ISV Operations

Every function of the organization will be impacted by a goal shift from implementing products to enabling customer adoption.

Sales & Marketing will be required to place more of their focus on customer retention. Professional Services will need to expand their charter across the entire adoption lifecycle, beyond mere deployment and into the ‘Effective Usage Domain.’ R&D will need to redirect a portion of their focus from features to usability. Effective partner management will be a strategic necessity for success, not merely a sales channel.

Key is that the operations of the entire organization are aligned to achieving the adoption-driven earnings opportunity. As realignments take place software executives will need to understand how much of their organization’s capacity will be invested in making their transformation successful to prevent negative impacts to employees and customers.

Figure 4: ISV Transformation Path to Sustainable Revenue Driven by Customers' Effective Adoption

Leaders will Avoid the ‘Perfect Revenue Storm’

Predicting the exact timing and nature of a pricing revolution is in reality folly. Even so, there is definitely a combination of vendor-centric and buyer-centric innovations occurring that threaten to breach the industry’s tipping point.

Software Executives are faced with the ‘Perfect Revenue Storm’ of:

- Shifting value expectations from

buyers

- Increasing transparency into software utilization

- Budget pressure created by economic conditions

Defensive moves are underway, as evidenced by industry consolidation, but another sustainable path is available to proactive, enlightened software executives – those willing to make the difficult leadership decisions needed to drive sustainable revenue growth and ensure long-term survival.

These successful executives will use the customers’ adoption challenge as a source of innovation and revenue growth – thereby avoiding the negative impacts of an impending pricing collapse.

- “Achieving Enterprise Software Success,” SandHill.com & Neochange, Inc., 2008.

- “Key Trends in Software Pricing and Licensing,” Study conducted by ECPweb,

Macrovision, SoftSummit, CELUG and EDA Consortium, November 2007.

- ServiceSource Corporation, 2008.

- “Application Portfolio Management and Enterprise Architecture — Agility Through Understanding”, Jim Duggan, Gartner Research Presentation, September 2005.

-

“Appliance-Based End-User Experience Monitoring, Q2 2007,” Jean-Pierre Garbani, The Forrester Wave, June 21, 2007.

Chris Dowse is Founder and CEO of Neochange Inc., a leading

management consulting firm focused exclusively on the complex challenge of

Effective User Adoption. He has consulted with IT executives of Fortune 500

companies such as Wells Fargo, Cisco, and McKesson in the areas of user

adoption, IT management and IT driven organizational change. As an internal

consultant to one of the world’s largest resource conglomerates (BHP, Biliton),

Chris has worked in 12 different countries identifying implementation risks and

benefit realization drivers for multi-million dollar capital projects. In more

recent years, he has turned his focus towards these same business challenges in

the software industry. Chris is a cited industry thought leader on user

adoption. He has presented at leading industry conferences and has been

published in industry publications on how software vendors and Fortune 500

organizations can address user adoption challenges. For article feedback,

contact Chris at

inquiries@neochange.com

|