|

|

| Home - Industry Article -

December 08 Issue |

Q3 2008 Software Industry Mergers and Acquisitions |

continued... page 2

We’ve repeatedly demonstrated in prior SEG Quarterly Reports that three

of the most important determinants of exit valuation are the seller’s product

category, equity structure, and size (Figure 23). The axiom held true in 3Q08.

We analyzed all M&A transactions year-to-date with ascertainable revenue

multiples to determine the specific impacts on valuation of equity structure

(private vs. public company), size (revenue) of buyer and seller, and the

seller’s software product category.

Figure 23: YTD Median Valuations - Segmentation

As a first step, we sorted these TYD transactions by equity structure,

separating public from private software company sellers to ascertain any

difference in median exit valuation. Public company sellers received a

year-to-date median exit value of 2.1x TTM revenue, while private sellers posted

a slightly lower median valuation, 2.0x TTM revenue. Over the past several

quarters we’ve seen the once substantial exit valuation variance between public

and private sellers lessen, as public stock market valuations and price tags

moderate. We expect this trend to continue so long as stock market valuations

remain at or near current levels.

As a next step in our analysis, we separated public and private software company

buyers to ascertain any difference in median purchase price paid. Here too, the

historical variance diminished. In transactions where an exit valuation multiple

was ascertainable, private buyers (both strategic and private equity) paid a

median M&A purchase price of 1.9x TTM. By contrast, public software companies

paid a median purchase price of 2.1x TTM.

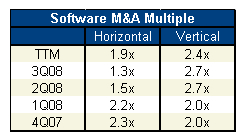

Additionally, we sliced the 3Q08 (not year-to-date) median software M&A multiple

horizontally and vertically, segregating vertical market software company

sellers (e.g. retail, financial services, telecom, manufacturing, etc.) from

sellers with horizontal software solutions (infrastructure, enterprise

applications, etc.). In 3Q08, providers of vertically-focused software

businesses accounted for 34% (Figure 24) of all software M&A transactions and

received an astounding median 2.7x TTM revenue (Figure 25) exit valuation, while

horizontal solution providers comprised 66% of sellers and received a dismal

1.3x TTM revenue valuation, a further decline from 2Q08’s already meager 1.5x

valuation. This is the second consecutive quarter we’ve observed this

phenomenon, which is in large part attributable to VCs cashing in vertical bets

placed several years ago. Notable vertical exits by VCs in 3Q08 included

Marketing Technology Solutions, sold to WebMD ($75 million, 3.6x TTM revenue);

and the sale of Clarix to Phase Forward ($40 million, 14.8x TTM revenue).

Hellman and Friedman’s leveraged buy-out of SSP Holdings ($394 million, 3.1x TTM

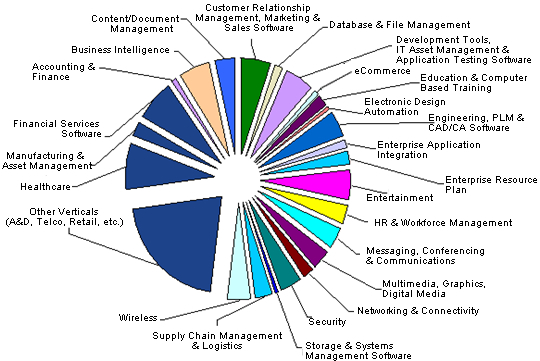

revenue) also helped to push up the median vertical valuation. Once again,

healthcare and financial services were the two most active software M&A

verticals in 3Q08, accounting for 22% and 20%, respectively, of all vertical

transactions (Figure 27).

Figure 24: 3Q08 Horizontal vs. Vertical Sellers

Figure 25: Horizontal vs. Vertical Software M&A Multiples

M&A Exit Valuations by Software Category

While company size and software delivery model demonstrably impact valuation,

software product category continued to be the single most important M&A

valuation driver. For most software product categories, there is often an

insufficient number of transactions that publicly report both seller TTM revenue

and buyer purchase price, essential data in ascertaining the applicable median

exit value for the product category. Consequently, we aggregate the data each

quarter on a TTM basis. As a result, it may take several quarters to detect

changing product category valuation trends and certain outlier transactions

consummated nine or twelve months ago may have a residual impact on their

product category multiples.

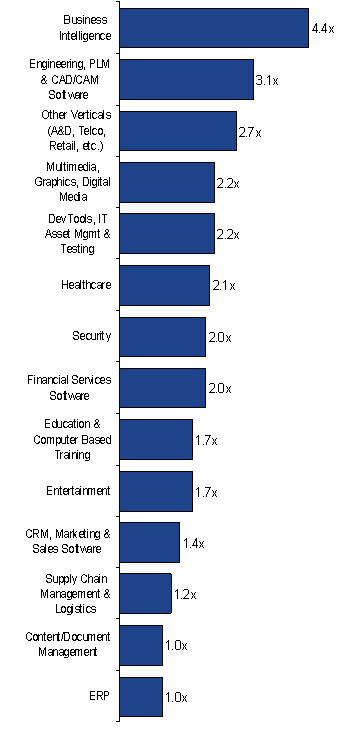

Among the 14 product categories we tracked in 3Q08 (Figure 26), business

intelligence led the pack, garnering a 4.4x TTM revenue median exit valuation.

The category continues to be buoyed by the 4Q07 acquisitions of Business Objects

($4.4 billion, 4.3x TTM revenue) by SAP and Cognos ($4.6 billion, 4.5x TTM

revenue) by IBM, as well as Microsoft’s 1Q08 purchase of Fast Search and

Transfer ($1.1 billion, 7.4x TTM revenue). As these fall off in the coming

quarters, we expect the BI median exit multiple to drop substantially.

Figure 26: Software M&A by Product Category

Engineering, PLM and CAD/CAM software followed second, posting a 3.1x TTM

revenue multiple. Transactions here were more recent and the product category’s

median exit multiple is consequently more reflective of the current market.

Deals in the category included Deltek’s 3Q08 purchase of Planview’s Micro-Frame

Program Management Division ($16 million, 3.2x TTM revenue), Autodesk’s 2Q08

acquisition of Moldflow ($190.1 million, 3.1x TTM revenue) and Synopsys’ 1Q08

acquisition of Synplicity ($215.8 million, 3.0x TTM revenue).

Vertical solution providers, which we aggregate into a single product category

for reporting purposes, received median exit valuation of 2.7x TTM revenue. The

category has steadily improved in valuation over the past year as a plethora of

VC-backed and public vertical software companies have been acquired at

impressive, and unprecedented, multiples. Exit valuations for the remaining

product categories ranged from 2.2x TTM revenue for providers of Multimedia,

Graphics and Digital Media solutions to 1.0x TTM revenue for Content and

Document Management and Enterprise Resource Management software.

Figure 27: Software M&A by Product Category

SaaS

SaaS providers remained highly attractive acquisition candidates in the third

quarter and continued to extract a significant exit premium compared to their

perpetual license counterparts. SaaS transactions in Q3 comprised a broad mix of

product category applications including workforce management, business

intelligence, supply chain management, security as well as legal and healthcare

applications.

Workforce management, which adopted the SaaS delivery model early on, added two

more SaaS transactions in 3Q08 including Monster’s acquisition of recruitment

and applicant tracking software provider Trovix ($73 million) and private equity

firm Bedford Funding’s acquisition of talent management software provider

Authoria ($63.1 million, 3.5x TTM revenue estimate). The SaaS project management

space has also seen recent activity including Serena Software’s 3Q08 acquisition

of Projity and NetSuite’s 2Q08 acquisition of OpenAir ($26 million), a provider

of both workforce and project management applications. Appendix E lists other

notable year-to-date SaaS transactions.

Please visit Software Equity Group LLC (SEG) to download a

complimentary copy of the full 3Q08 Software Industry Equity Report, which

analyzes software industry public company stock market performance, initial

public offerings, mergers and acquisitions, and venture capital and private

equity placements. The group is an investment bank and M&A advisory serving the

software and technology sectors. Founded in 1992, SEG has represented and guided

private companies throughout the United States and Canada, as well as Europe,

Asia Pacific, Africa and Israel, and has advised public companies listed on the

NASDAQ, NYSE, American, Toronto, London and Euronext exchanges. The group also

represents several of the world's leading private equity firms and was recently

ranked among the top ten investment banks worldwide for application software

mergers and acquisitions.

|

|

|