|

|

| Home - Industry Article -

February 09 Issue |

Maintenance Revenue Protection 2.0: The Urgent Threat and the Solution |

By Chris Dowse, Founder & Chief Executive Officer and Ben Galison, Principal, Neochange

With the software industry realizing the changing customer needs,

Chris Dowse and Ben Galison of Neochange share their insight into the steps

which software vendors can implement to shift towards the buyers’ perception of

value to prevent threats to maintenance revenue. This article explores the

magnitude of the increased threat and provides a three-step approach with

concrete actions all ISVs can take to protect critical maintenance revenue

streams and even grow services revenue.

Software vendors must act now to address the clear and present threat to

maintenance revenue. Long the software industry’s cash cow, maintenance and

support revenue delivers high margins that fund product R&D and is used as the

basis for company valuations in mergers and acquisitions and financing

arrangements. Multiple forces have converged to intensify the threat, including

market shifts towards buyer perceptions of value, tough economic conditions,

industry consolidation and unprecedented transparency into software usage.

In 2006, Neochange, a leading-edge management consulting firm, committed to

shifting industry norms towards greater value realization from investments in

software, technology and process reengineering, published an article on

maintenance revenue protection that was downloaded over 3000 times, indicating

this as a hot topic among ISVs. Large software vendors are already responding to

the threat. This new article explores the magnitude of the increased threat and

provides a three-step approach with concrete actions all ISVs can take to

protect critical maintenance revenue streams and even grow services revenue.

The threat to software maintenance revenue has become clear and present.

Long the software industry’s cash cow, maintenance and support revenue provides

high margins that are the funding engine for new product research and

development. The maintenance revenue stream is also used as a basis for company

valuations in mergers and acquisitions and financing arrangements. Protecting

maintenance revenue is a hot topic for independent software vendors (ISVs); a

2006 Neochange article on the subject had over 3000 downloads.

Multiple forces have converged to intensify the threat. The industry’s shift

towards buyer perceptions of value has brought downward pressure on both price

and sales volume, eroding the revenue basis on which the maintenance percentage

is calculated. Tough economic conditions have created more sales declines and

upgrade delays, making ISVs more dependent on maintenance as a larger share of

their total revenue. Struggling ISVs are especially vulnerable, relying on

maintenance revenue to fund operations as the recession makes venture funding

and bridge financing more challenging.

New end user monitoring technology (EUM) adds to the peril. Unprecedented

transparency into software usage exposes underused applications and enables

visibility into whether customers are getting actual ROI on their application

investments. In today’s cost-cutting environment, software with low levels of

effective usage puts maintenance contracts at risk of cancellation or discount.

The good news is that ISVs can protect their maintenance revenue stream and even

grow services revenue by becoming more customer-centric and making customers

visibly successful through effective adoption.

Companies can increase customer effective usage of software products through an

integrated, sequential program of improvement. For sustainable impact, each

company’s detailed approach should take into consideration its organizational

capabilities and areas of greatest risk, but the basic sequence can be summed up

as follows.

Step #1 – Mobilize Internally: Improve Customer Experience Throughout the

Company

On the surface, the concept of becoming a more customer-centric company is

hardly new. Yet aspects of this shift are essential to achieve and sustain the

changes that provide a foundation for maintenance revenue protection. Without a

core operation that can effectively support and service its customers,

protection efforts will be band-aids at best, doomed to fail in the long run.

Ensuring a positive customer experience builds customer loyalty is an important

part of protecting maintenance revenue. Surprisingly, it can also reduce

operating costs for the ISV.

Customer experience improvement needs to come from the support and services

functions, the primary touch-points for existing customers. By focusing on

effective internal adoption of the CRM, PSA and other delivery systems, ISVs can

streamline and improve the quality of customer interactions to deliver better

service levels.

The results can be impressive. One Fortune 500 company used its CRM adoption

initiative to identify annual benefit equivalent to nearly 3% of its annual

revenue. Over 40% of the benefit was hard cost savings achieved by reducing

support staff user errors, improving workflow navigation and simplifying

customer facing screens to simultaneously lower problem resolution times and

improve customer retention. A second Fortune 500 company was able to increase

professional services staff productivity by 11% through more effective PSA

adoption while increasing the delivery quality of services.

Another positive by-product of successful CRM/PSA adoption is the sharing of key

customer information across the organization. In many ISVs, customer knowledge

exists in fragmented form, trapped within organizational silos, disparate

systems and the minds of a few individuals. This fragmentation is a barrier to

the flow of key information necessary for effective customer support. Effective

CRM/PSA usage institutionalizes the cross-functional customer perspective

essential for a software company to deliver useful support and services and to

respond quickly to revenue risk situations that demand immediate action.

To improve the customer experience, leaders will need to facilitate a

cross-functional dialog and empower employees across support, services, account

management and sales groups with identifying top customer problems and proposing

solutions. Leaders can use the maintenance revenue threat as a burning platform

for change, communicating a company-wide vision for customer retention through

improved customer experience. Executives should drive collaborative action and

results with clear goals (e.g. targets for percent reduction in cancellations,

number of major account renewals and published customer ROI/success stories).

Incentives for executives, teams and account owners will need to be realigned to

foster cooperative efforts.

ISVs that are easy to do business with and meet or exceed customer expectations

through more effective adoption of internal customer-centric technologies will

be ready to ‘walk the talk’ and apply their newfound adoption capabilities to

their own products with existing customers.

Step #2 – Extend the Experience: Understand Customer Usage and Barriers to

Success

Customers struggle with adoption and are seeking help with their usage problems.

Most are interested in developing a new relationship with their vendors that

meets this need. A recent survey by Neochange and Sandhill revealed that almost

two-thirds of enterprise buyers achieve less than 49% effective adoption. With

customer experience improved and the adoption discipline institutionalized, ISVs

can turn their attention externally to understand where customers are struggling

with the ISV’s own products.

Shared internal knowledge alone is insufficient to address customers’ adoption

problems. ISVs also need to reach out proactively to customers to understand

their effective usage patterns and identify adoption barriers in the customer’s

environment. The adoption discipline coupled with EUM technology is a powerful

combination to achieve this purpose.

ISVs can work closely with selected customers to monitor their effective usage

of the ISV’s products. An adoption ‘health-check’ will reveal low effective

usage areas of the application as well as low-adoption groups within the user

base. Both are opportunities to help the customer make better and more

consistent use of the product, across a wider user base, to realize greater

business value. While underlying needs should be analyzed, interventions may

include delivering additional training and services (e.g. agile configuration,

workflow and usability improvements) to shore up gaps. This adoption

health-check also provides an opportunity to deepen the customer relationship.

Gains in effective usage and resulting financial benefits – the actual ROI –

should be broadly communicated within the current customer environment to boost

confidence and loyalty. The success story can also be disseminated to other

customers through press releases, white papers, user communities, blogs and

other channels. Ultimately, ISVs should leverage intelligence and insights about

customer effective usage patterns to identify and implement high-impact product

improvements and services modifications (e.g. refining training programs and

implementation methodologies). Product Management, Services and Sales &

Marketing all benefit. Adoption insights and actual usage data can be further

used to quash erroneous perceptions (e.g. slow application response times) and

identify problems not caused by the software product, such as skills/experience

gaps and inconsistent practices across the user base.

Still further, ISVs can use their insights into customer effective usage and

drivers of business value to create new services that will stimulate the upgrade

cycle. Effective adoption is the industry’s current limit to growth.

Step #3 – Lead Customers to Success: Capture Revenue Opportunity

Customers are willing to pay for a new relationship with their vendors, but

vendors will need to deliver the business value that customers need – not just

technical services.

The Neochange/Sandhill survey identified effective adoption as the most

important factor for realizing business value from technology and indicated over

80% of customers are willing to pay for services that enable this. Yet ISVs have

historically focused on technical support and traditional implementation

services. For every dollar spent on implementation, customers will spend at

least another dollar on value realization.

Knowing this, ISVs should re-orient their service portfolio more towards the

goal of customer value realization. The effort starts with the existing customer

base by developing an adoption focus within the support and service delivery

functions. The benefits are considerable. Effective user adoption increases

customer switching costs, enables value-based pricing that prevents price

erosion, produces visible ROI for customer success stories to drive other sales

and provides a platform for up-selling and cross-selling.

Furthermore, since a rebalanced portfolio mix would include a lesser proportion

of implementation-focused services, which typically have a lower margin, overall

service profitability will improve. This is a win/win case for both ISV and the

customer. The Neochange/Sandhill survey indicated that 95% of customers were

seeking a new relationship with their vendor that includes greater leadership in

software adoption.

Large enterprise ISVs, such as Oracle, SAP and CA understand the maintenance

revenue threat and importance of adoption and have begun taking steps to address

the problem. SAP makes itself a responsible partner to reduce customers’ total

cost of ownership and increase benefits, using scorecards to measure value

realization. At CA, “customer value experience” teams work cross-functionally

across the enterprise to increase user adoption and customer satisfaction as

well as deliver new value approaches.

ISVs can establish value assurance services by reorienting existing services as

well as developing new offerings with specific value-enhancing objectives. EUM

can be used to baseline effective usage and demonstrate achievement of gains as

improvement recommendations are implemented. In all cases, value assurance will

be achieved through cross-functional efforts involving a high degree of

communication and collaboration. Services partners, working on behalf of the

customer in a trusted advisor role, can be instrumental to ISVs in helping

customers realize value. Value assurance services may include customer ROI

acceleration offerings, business domain maturity assessments and organizational

change leadership.

These extended services provide new paths to value for customers, thereby

deepening the customer relationship while driving additional services revenue.

Innovate to Thrive

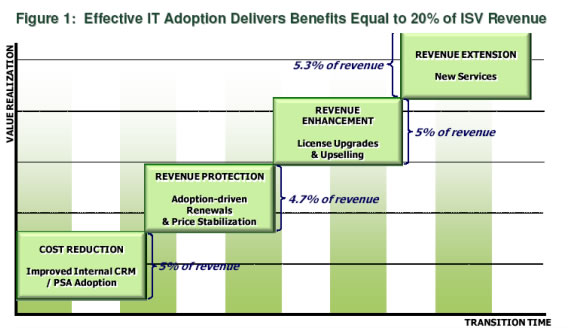

Taken together, these three steps can produce financial benefits equivalent to

over 20% of annual revenue, including cost reduction from CRM/PSA adoption,

protection of maintenance revenue, revenue enhancement from license upgrades and

up-selling as well as revenue extension from new services (see Figure 1). While

the current business environment makes an economic opportunity of this magnitude

difficult to imagine, the technology industry’s history is built on examples of

innovation driving subsequent waves of growth.

Faced with the ‘perfect revenue storm’ of current economic conditions, industry

consolidation, and increased usage transparency, ISVs must act now. Moving

forward, customer perceptions of value will continue to drive the software

industry.

The economic opportunity for those willing to make the changes and investments

to mobilize can be lucrative, but many ISVs will not survive the industry shift.

Successful executives will use customers’ adoption challenges as a source of

revenue growth and innovation to thrive through challenging times.

Chris Dowse is CEO and Founder of Neochange, Inc. Ben Galison is

a Principal with Neochange. It is the leading management consulting firm focused

exclusively on the complex challenge of Effective IT Adoption. Neochange’s

innovative AdoptITTM methodology mitigates adoption risk and accelerates

corporate earnings improvement. For article feedback, contact Chris and Ben at

inquiries@neochange.com

|

|

|