|

|

| Home - Industry Article -

February 09 Issue |

How Will the Software Industry Fare the Worst Recession in 80 Years? |

By Ken Bender, Managing Director and Kris Beible, Analyst – Software Equity Group, LLC

Frozen credit markets, plunging stock markets, mounting unemployment,

slashed IT spending…what does it portend for the software industry? Can the

software sector avoid the wave of forced buyouts, bailouts and bankruptcies that

have upended the automotive, financial services, housing and retail sectors? We

believe so.

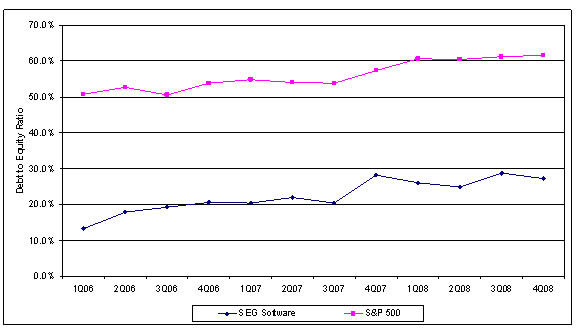

First and foremost, the software industry is largely isolated from the frozen

credit markets and the need to raise debt to continue operations. Unlike other

industries, the software industry does not require large capital outlays to fund

massive projects (e.g. real estate), invest in property, plant and equipment

(e.g., manufacturing) or bridge payroll. Additionally, for the past 20+ years,

software has been a growth industry, enabling companies to self-fund and avoid

Wall Street pressure to incur debt as a means to reduce their cost of capital,

yielding higher returns on assets and equity. While this trend is changing as

the industry matures (Figure X), the modest 27% median debt-to-equity ratio

(defined as total debt divided by common shareholders’ equity) of the 196

software companies comprising the SEG Software Index, continues to be dwarfed by

the hefty 62% median debt-to-equity ratio of the debt laden S&P 500. Those in

our industry that will feel the pain of the credit market are private equity

firms and a relatively small number of public software companies that got

accustomed to using debt to finance M&A transactions. The debt financing door,

as JDA Software experienced in early December when it scrapped its $346 million

purchase of I2 Technologies due to an inability to secure funding, is shut.

Software also has a distinct advantage over other industries from a working

capital perspective. Working capital, a financial metric, which represents a

company’s operating liquidity by comparing current assets to current

liabilities, is a company’s oxygen supply. Drawing down working capital by

draining cash at the expense of short-term liabilities may provide short-term

benefit, but not for long. Mismanagement of working capital, which could

encompass imprudent handling of inventories, accounts receivables, payables,

short-term debt and/or cash, has proved fatal for many companies. Here, as well,

software companies are able to maintain excellent working capital because of

large cash reserves, little to no inventory and minimal, if any, short-term

debt.

In comparison to the S&P 500, the median current ratio (current assets divided

by current liabilities) of the SEG Software Index is 1.9x versus 1.5x (Figure

Y). Measuring the median quick ratio, which measures a company's ability to meet

its short-term obligations with its most liquid assets (i.e., excludes inventory

from current assets when calculating current ratio), software companies are that

much healthier due to the lack of inventory. The quick ratio for the SEG

Software Index and the S&P 500 are 1.6x and 0.8x, respectively.

Included in both working capital and the quick ratio calculation is deferred

revenue – perhaps the single largest liability on any software company’s balance

sheet. While it has a valid GAAP accounting function, deferred revenue,

typically unearned maintenance & support revenue or subscription revenue, it is

generally recognized to be something less – sometimes much less – than a true

dollar-for-dollar liability. Unlike payables or debt, the actual cost for

deferred revenue is ordinarily a fraction of the booked liability. If deferred

revenue on a software company’s balance sheet was reduced to reflect the actual

cost of providing the service/support, the company’s current and quick ratios

would be concomitantly stronger.

Finally, software companies have the fortitude to weather the storm from an

income statement perspective. While it is true that the frozen credit markets

and recession will impact software company income statements via diminished

revenue growth, we must not forget the median software company’s annual revenue

growth is 145% of the median S&P 500 company. Certainly, these growth rates will

slow considerably in the current economy (Figure Z), perhaps dropping to single

digits for the first time in the industry’s history. Still, software companies,

unlike most businesses, scale remarkably and are capable of generating

significant operating profits even in difficult markets. Few companies outside

the software industry can generate a single product that can be sold to multiple

customers with virtually no incremental expense and/or capital cost. What’s

more, software companies have virtually no property or plant to depreciate, no

finished goods inventory or raw materials to expense and few, if any, shipping

costs. In lieu of these expenses are costs that are predominately variable,

enabling a software company to be especially fleet of foot in adapting to a

recessionary economy. Fully 70% of the typical software company’s operating

expenses are attributable to labor, allowing the company to readily reduce

headcount to bring costs in line with declining revenue. Few, if any, industries

have such flexibility.

Finally, software providers are buoyed from the economic undertow by significant

amounts of recurring revenue. The quintessential survival tool, recurring

revenue gets modest respect when the economy is strong – but in lean times, when

new licenses are scarce and upgrades slow, recurring subscription revenue or

maintenance and support (M&S) revenue is life support. The traditional

application software company typically derives fully one-third of its total

revenue from annual maintenance and support. It’s usually high-margin revenue,

paid for with one or two updates and new releases a year and some help desk

support. Even in tough times, application software companies rarely see more

than 5% attrition in their M&S base. It’s a nice cushion most other industries

lack.

FIGURE X

FIGURE X

Software Equity Group is an investment bank and M&A advisory

serving the software and technology sectors. Founded in 1992, the firm has

represented and guided private companies throughout the United States and

Canada, as well as Europe, Asia Pacific, Africa and Israel. They have advised

public companies listed on the NASDAQ, NYSE, American, Toronto, London and

Euronext exchanges. Software Equity Group also represents several of the world's

leading private equity firms. They were recently ranked among the top ten

investment banks worldwide for application software mergers and acquisitions.

For more, please visit

www.softwareequity.com.

|

|

|